Last week, at a public meeting, I was asked several times if this famed "peak oil" has arrived or not. People who have heard of peak oil seem to be becoming impatient, but I am afraid we'll have to wait a little longer. Peak oil is not here yet, at least if we intend it as a significant decline in the production of combustible liquids. Does that mean that the predictions based on the Hubbert model were wrong? In a sense, yes: you should know that all models are wrong by definition. Some, however, can be useful if you know how to use them. That's the case of the Hubbert model: it had given us a useful warning that, however, we chose to ignore. Let me explain this point by means of a summary

of a talk that I gave at the conference on the future of energy organized in Basel

by the Club of Rome on 16-17 october 2011. A few months have passed

since I gave that talk, but things haven't changed much from then.

Good afternoon, ladies and gentlemen. My time today is short, so I'll try to go as fast as possible, limiting myself to a brief discussion on the models that lead to the concept called "peak oil." From that you can make up your mind yourselves on what's happening today to the oil market and how the economy could be affected.

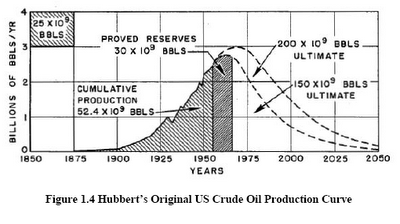

So, first of all, what is "peak oil"? The term was introduced by Colin Campbell in 2002 to indicate the "tipping point" in the world oil production, that is the point when the historical production maximum is reached and an irreversible decline starts. But the idea of a "production peak" for oil is much older. It goes back to a paper that Marion King Hubbert presented in 1956, where he proposed that the production of crude oil in the United States (more exactly in the 48 lower states) would follow a "bell shaped" curve. Here is the curve that Hubbert proposed

You see that the curve is supposed to have a peak midway, and that is the element that has gained most of the attention today. The date of the peak, in particular, has taken a certain value of prophecy. And there is no doubt that Hubbert got something right. Here is a comparison with the historical data.

Now, as you can see, the agreement with the historical data of one of the curves proposed by Hubbert is very good. Actually, it is excellent considering the time span involved. It is not so easy to make a prediction that turns out to be so good 14 years afterward! And the prediction continued to be good for many years, until recently, when production showed an increase that moved it away from the Hubbert curve. But, again, that doesn't detract from the fact that Hubbert had clearly predicted that production would run into troubles at a certain point. It did.

So. let's go to "Peak Oil", the worldwide peaking of oil production. In the same 1956 paper where he had estimated the date of the US peak, Hubbert made the first serious study of how long the world's oil reserves would last. It was a difficult task, because the world's oil resources were not so well known at that time, but Hubbert attempted it. So, let's see what were his results:

As you see, the curve for the world has the same shape as the one for the US states and the peak was supposed to occur around the year 2000. In later times, other authors revised Hubbert's study using similar methods. For instance, Campbell and Laherrere in 1998 saw the peak for around 2005. Later on, ASPO (Association for the study of Peak Oil) revised these predictions finding the peak somewhere between 2005 and 2010 (see, for instance, these 2007 predictions).

How do these results compare with the actual historical data? Let's see some data by Euan Mearns, which include not just crude oil, but also condensate and natural gas liquids.

We don't see a peak for the year 2000, nor we see it for 2005. If the peak had been in 2000 or 2005, we should be already seeing a significant production decline. What we see, instead, is a plateau that has been lasting for the past five years or so, interrupting the growth trend that had been the rule from 1983. So, no peak so far, but clearly "something" has been happening with oil production starting with the first decade of the 21st century, considering also the remarkable increase in oil prices of that period. But what's happening, exactly? Where is the peak? Should we expect it soon, or is it delayed for a long time?

I think that at this point we need to pause for a moment. What is exactly a model and what can it be used for? Models come in a variety of forms: formal, informal, complex, simple, aggregated, multiparameter and more. But, no matter what model you are using, one thing that can be said is that if you think it can predict the future, I am afraid that you are going to be sorely disappointed. Complex mathematical models may not be any better than the crystal ball that is part of the toolbox of any self respecting magician. Models are no magic. Models are just tools. And, just as with any tool, you need to know how to use them, otherwise you risk to hurt yourself.

The future is not an easy thing to study. It always fans out in multiple paths as you move onward. So, you use the models not in order to make predictions, but to understand what path you have taken. Without models, you are walking on, blindly, and you have no idea of where you are going. With models, it is like having a flashlight. You may not be able to see far away in the darkness, but at least you have some idea of what you are stepping on. Good models will give you a longer range, less good ones will be more limited. But if you know what your model can do (and what it can't do) then a model can always be useful.

We can apply these considerations to peak oil models. The simplest version, as we said, is Hubbert's one. We could call it a "first order" model as it assumed that the main factors affecting oil extraction are related to geology and that the industry would continue to act as usual, even when facing the peak. But that didn't happen. The market reacted with increasing oil prices and the production system adapted by pouring investments into the exploitation of expensive oil resources that the Hubbert model didn't consider as extractable. In a sense, the future was changed by a "second order" factor: prices. And so we took a different path; we didn't have a peak; not yet, at least.

But the Hubbert model had not been "wrong;" it had done well within its limits. It had given us a useful warning that we should have expected troubles with oil production during the first decade of the 20th century. We chose to ignore that warning and we were taken by surprise by the price spike that is causing us a lot of troubles. The future always surprises you, especially if you don't have good models.

What should we expect now? Well, we don't need a formal model to understand that the oil industry can keep extracting oil as long as there are customers able to pay for it. The problem is that, with progressive of depletion, extraction costs can only increase as we tackle more and more difficult, dirty, and remote resources. That will be continue to generate high prices. So, we'll have peak oil when we won't be able to pay these prices any longer.

If you like a formal model that takes into account these factors, you may give a look to my "Seneca Model". It generates a production curve like this one:

Is this the future? Possibly; but always remember that if a model is a flashlight, it doesn't show to you more than a dim impression of a number of different paths that the future may take. Don't take the Seneca model as a prediction. We cannot predict the future, we can only be prepared for it.

_____________________________

On the Hubbert model, you may be interested to read these posts of mine

"No Peak Oil Yet? The limits of the Hubbert Model" http://www.theoildrum.com/node/7241

"Mind sized Hubbert" http://www.theoildrum.com/node/5731

"A simple interpretation of Hubbert's model of resource exploitation", http://www.mdpi.com/1996-1073/2/3/646

"Peak Eggs: Hubbert and the Easter Bunny" http://cassandralegacy.blogspot.it/2012/04/peak-eggs-hubbert-and-easter-bunny.html