This is a translation from Italian of a post by Marco Pagani on the blog "Ecoalfabeta" based on a comment by Antonio Turiel on the recent IEA report on the future of petroleum and fossil hydrocarbons.

by Marco Pagani

The IEA forecast for the future of petroleum are not only too optimistic, but also wrong because they are based on summing volumes of fuels which have different output and energy costs of extraction. Here you find the correct analysis, much less reassuring

by Marco Pagani

The IEA forecast for the future of petroleum are not only too optimistic, but also wrong because they are based on summing volumes of fuels which have different output and energy costs of extraction. Here you find the correct analysis, much less reassuring

What will be the future of oil? Antonio Turiel recently published a very interesting post on his blog, The Oil Crash. Turiel's post is very long and detailed, let me try here to summarize it to make it more easily understandable.

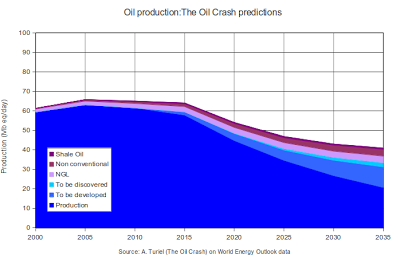

The figure above shows the IEA's predictions, where it is hoped to arrive to nearly 100 million barrels per day in 2035 (1). These predictions, however, are totally wrong for two reasons:

- Non-conventional fuels (liquefied natural gas, bitumen, shales, etc,) have a gross energy content per unit volume that is approximately 70% of conventional crude oil and, for this reason must be counted in terms of "equivalent barrels" .(2)

- We need to consider the "net energy" that can be obtained from a given amount of fuel, because every fuel has an energy cost of production that must be subtracted from the total (3) che va sottratto dal risultato finale.

However, the IEA forecast is very optimistic also for other reasons, mainly because the decline in production will be more marked than assumed (-5%/year instead of -3%), the wells to be developed will be usable at 50% and those to be discovered are probably assumed to be four times what would be a realistic evaluation. The same is true for non conventional oil.

According to Turiel, therefore, a more realistic future scenario is the following:

Notes

(1) The IEA predictions include also refinery gains, which are not shown here because, as Turiel notes, these gains are obtained at the expense of energy obtained from natural gas.

(2) the ton equivalent of petroleum (tep) represents a mass of fuel containing an energy of 42 GJ. A barrel-equivalent equals 0.146 tep

(3) EROEI (Energy Returned On Energy Invested) is the ratio x=Et/Ei (hence Ei=Et/x) between the total energy produced and the energy spent in input. The net energy (En) is therefore the fraction of energy that can be obtained from the resource En = Et-Ei and En= Et - Et/x = Et (1-1/x) = Et y, with y is the yield.

The values of x and of y =1-1/x used by Turiel are:

| x | y | |

| Crude oil | 20 | 0,95 |

| To be developed | 5 | 0,80 |

| To be discovered | 3 | 0,67 |

| LNG | 5 | 0,80 |

| Non conventional oil | 2 | 0,50 |

| Shale Oil | 2 | 0,50 |