Guest post by Diego Mantilla

Peak oil by any other name is still peak oil.

One of the most compelling charts I have ever seen is the “Growing Gap” chart that used to appear in every ASPO Newsletter. This is the one from the last ASPO Newsletter, written by Colin Campbell and published in April 2009.

Since then, more than seven years have passed, and peak oil has disappeared from the mainstream press headlines--almost. On August 29, Bloomberg published a story alerting to the fact that conventional oil discovery has reached a 70-year low. It published a very interesting chart, using data provided by Wood Mackenzie, the oil consulting firm, to show that fact. Unlike the ASPO chart, Bloomberg's chart only goes back to 1947, the year before Ghawar was discovered.

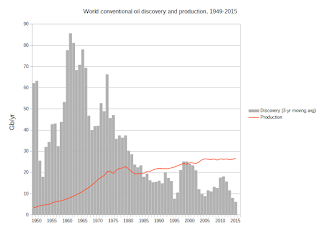

I thought I would reproduce the “Growing Gap” chart using Wood Mackenzie's data.

Neither Wood Mackenzie nor Bloomberg make public the data behind the chart, but I used a digitization program, WebPlotDigitizer, to extract data from the chart. The results are not perfect, of course, but give a good enough estimate. One must keep in mind that discovery data are not precise and may have a significant margin of error.

In order to obtain conventional oil production, I subtracted US tight oil production and Canadian tar sands production from the EIA's global crude plus condensate number. I know I must also subtract the extra-heavy production from the Orinoco Belt, but it is hard to find data for it. In any case, this is a very good estimate. According to data gathered by Jean Laherrère, the Orinoco extra-heavy production is only around 1 Mb/d today.

The following chart shows the digitized Wood Mackenzie conventional discovery data and the production data described above. According to the data, since 1980, when the gap between production and discovery began to appear, humanity has extracted about 47 percent more conventional oil than it has discovered.

And the following chart shows a three-year moving average of discovery, to replicate the ASPO chart. Notice that discovered volumes are generally larger than Campbell's data, but the drop since 2011 is more precipitous than he anticipated.

According to the Bloomberg story, this shortfall in discovery will be felt 10 years from now, when it begins to “hinder production.”

Peak oil by any other name is still peak oil.